My family lost our house when I was fifteen years old in 2008. I remember coming home to boxes and bins in the driveway and my parents sifting through them, an attempt to downsize, when they broke the news to me. They were upside down, preparing to file bankruptcy, and going to let the house foreclose. The following semester, I wrote a research paper about it for high school history class. In college I came across the movie The Big Short, which I’ve now watched more times than I can count. Since the pandemic in 2020, I’ve avidly consumed everything I can get my hands on about economics. Recently, I’ve been re-reading The Big Short Inside The Doomsday Machine, and noticing some alarming similarities.

I am not officially predicting another housing crisis, or suggesting what anyone should do with their money – I’m not that smart. I personally feel that a deep downturn in the economy is coming, specifically tied to over extension of credit similar to the lead-up to 2008. I’d like to present the facts that have lead me to my conclusion.

*This article was written before Trump’s “Liberation Day” tariffs were announced. Aside from the direct pain the tariffs have, and will, cause (increased prices, stock sell offs. etc), I expect the tariffs will be an accelerant to the deeper downturn. The true cause being the over extension of credit both public and private. Tariffs are the fuel soaking into the logs, waiting for a match.

1. Rising Fraud

Michael Burry, an investor who spotted the 2008 housing crisis years before it happened, wrote about his prediction, “There are specific identifiers that are entirely recognizable during the bubble's inflation. One hallmark of mania is the rapid rise in the incidence and complexity of fraud.…” - The Big Short, Michael Lewis

Currently, the FTC reports a 11% increase to the number of consumers losing money to fraud from 2023 to 2024, coupled with an increase of 24% in the amount of money actually lost across those years. The source reads, “According to the FTC’s data book, this number is not driven by an increase in fraud reports, which remained stable. Instead, the percentage of people who reported losing money to a fraud or scam increased by double digits. In 2023, 27% of people who reported a fraud said they lost money, while in 2024, that figure jumped to 38%.” - FTC Public Affairs

You’ve also likely heard of at least one crypto related scam in the never-ending parade of them. These scams take advantage of the complexity of crypto wallets, the products, the contracts, and the array of bots and tools used to exploit the market. Some scams you may want to look into: Trump coin; Hawk coin; FTX; OneCoin; BitConnect; Luna/Terra; all the “Ape” NFTs and NFT games that never materialized. - FMC Pay

In fact, as I’m writing this, AP News just broke a story stating, “World Liberty Financial (a cryptocurrency venture Trump helped launch last year) has announced that it plans to launch “USD1”, a stablecoin pegged at a 1-to-1 ratio to the U.S. dollar.” - AP News Why stop at one scam (Trump Coin), when you can have multiple? Trump is legitimizing fraud as the acting president.

Let’s not forget, Elon Musk’s government position has allowed him to dismantle Government agencies investigating his companies. An open letter by Representative Mikie Sherrill neatly outlines all of Musk’s conflicts of interests and calls for Inspector Generals to investigate. Unfortunately, on January 24, 2025, one of Trump’s first actions was the immediate firing of at least 17 inspectors general across various federal government cabinet departments and agencies. Smells like fraud.

List of Musk Conflicts and Fraudulent Actions paraphrased from Rep. Mikie Sherrill’s letter

Department of Transportation

Federal Aviation Administration

Using federal funds to support his own business by shifting the FAA’s purchase contract for new equipment from an already contracted company (Verizon), towards a company owned by Musk (SpaceX). Musk also openly complained about the FAA taking to long to approve SpaceX launches.

National Highway Traffic Safety Administration (NHTSA)

Heavily regulating self-driving vehicles due to safety concerns. They have numerous suits against Telsa. Senior Advisor says, “I’ve lost count of the number of investigations that are underway with Tesla. They will all be gone.”- AP News

Department of State

In 2025 the State Department announced intention to purchase approximately $400 million worth of armored Tesla Cybertrucks. Public reporting, however, showed that in November 2024, the State Department had only approved $483,000 to purchase electric vehicles. This dramatic increase in a proposed contract for Tesla is deeply troubling given Mr. Musk’s influence over federal contracts and spending.

Department of Commerce

In March 2025, the Broadband Equity, Access, and Deployment program, originally geared to install fiber-optic cable line to remote houses, was abruptly changed to instead use Musk’s Starlink company satellite equipment. A departing email from the head of the program said that Starlink would offer slower speeds at higher costs to households than fiber-optic cables.

Department of Defense

SpaceX is one of the Department of Defense’s primary contractors for space launch services, $7.6 billion in funding received since 2003. Additionally, public reporting has indicated that SpaceX has also been awarded nearly $2 billion worth of classified contracts by DoD. DOGE is currently reviewing DoD contracts and budgets, providing the staff the opportunity to potentially improperly funnel additional funding to SpaceX contracts.

National Aeronautics and Space Administration, NASA

In total, SpaceX CEO Gwynne Shotwell has said the company has approximately $15 billion in NASA contracts. After Mr. Musk began his work at DOGE, NASA announced it had selected SpaceX for an approximately $100 million contract. Mr. Musk has also advocated for the early dismantling of the International Space Station in the next two years, which is currently contracted to deorbit in early 2031. Public reporting indicates that DOGE staff are currently embedded in NASA developing budget and personnel cuts, giving them the opportunity to potentially impact future SpaceX contracts.

General Services Administration

In February 2025, the General Services Administration installed a Starlink terminal at the agency’s Washington headquarters at the request of DOGE staffers and for their use. The installation happened within days of the request, compared to the typical weeks- or months-long process needed for security and procurement review. DOGE and GSA have not provided any explanation for why GSA’s existing internet would be insufficient to support the handful of DOGE staffers working in the GSA headquarters. In addition, Starlink terminals have now been installed across the White House complex. Specific requests to use federal funds to purchase and expand the visibility of Musk’s equipment by high-profile usage at government facilities, raise significant conflict of interest questions.

Securities and Exchange Commission

In January 2025, the Securities and Exchange Commission filed a lawsuit against Mr. Musk alleging that he misled investors about his purchase of Twitter in 2022. The SEC previously won a securities fraud settlement against Mr. Musk requiring him and Tesla to each pay $20 million in penalties. SEC employees were among the federal employees offered $50,000 “buyouts” to voluntarily resign, which could impact the ability of the agency to bring and win enforcement actions like those filed against Musk. DOGE is currently active at the SEC and is reportedly working to cut additional SEC staff in the coming months.

National Labor Relations Board

In February 2025, the General Services Administration – acting on behalf of DOGE – attempted to cancel the lease for the NLRB’s Buffalo office, which would greatly impede their ability to proceed with labor protection cases.

President Trump also illegally fired an NLRB board member – before she was reinstated by a federal judge in March – which would have paralyzed the agency’s ability to hear cases pending against SpaceX and Tesla.

The National Labor Relations Board is currently considering a case against SpaceX brought by eight employees who allege they were illegally fired for criticizing Mr. Musk. In response, SpaceX filed a suit challenging the constitutionality of the NLRB entirely in 2024.

The NLRB has also filed complaints against Tesla accusing the automaker of illegally discouraging workers from forming a union, including tweets by Mr. Musk himself threatening the compensation of employees who unionized.

Consumer Financial Protection Bureau

Trump and Musk’s Department of Government Efficiency are taking steps to dismantle the CFPB, a consumer protection agency that’s taken numerous steps against predatory behavior by student loan companies.

2. Consumer Debt

The main trigger of the housing crisis was defaults on debt. This was magnified through investment instruments that were proliferated through fraud. Various institutions lied about and obfuscated the risk, returns, revenue, losses, etc of these investment instruments as they peddled them to the American consumer and to each other (turning the whole situation global).

Now, this debt instrument would actually be fine if the borrowers could repay. The issue was that they suddenly couldn’t. Forgive this oversimplification, but essentially, lenders made loans to consumers any way they could; mainly through low introductory rates, but also to unqualified borrows (little to no income). The lenders, holding this risky debt, then manufactured ways to make it look less risky on paper, ultimately selling these debts off to other investors (as “asset backed securities”). Why would someone buy debt? Because the debt repayments act as income for the holder of the debt. The new owner is now holding the risk of the borrowers defaulting.

Basically, lenders made money by creating loans to later package together and sell. the more loans, the more product they had to sell. Acclaimed investor Charlie Munger, in 1995, gave a talk at Harvard Business School called "The Psychology of Human Misjudgment." This birthed an insightful, albeit obvious, quote, “If you wanted to predict how people would behave, Munger said, you only had to look at their incentives.” The incentive was to make money, and a risk free way to do so appeared. Of course they took it. Is the incentive any different today? Has it been any different at any time in America’s history? No, not really.

This brings us to today. Look around and you’ll see: wildly inflated car prices meaning huge auto loans; the rise of “buy now, pay later” (BNPL) companies like Affirm and Klarna; employers partnering with “wage advance” apps that are just gateways to installment loans; the most student loan debt ever recorded; insanely high housing prices (maybe I’ll talk about how this is ruining home insurance in another article); and an alarming amount of credit card debt just to name SOME of the pressures affecting consumers.

NBC News reports that households below $73,000 are increasingly using credit cards to maintain purchasing power. The average annual percentage rate of a credit card is above 20%. As a result, the share of credit card accounts showing delinquencies of at least 90 days overdue has climbed to more than 11%, the highest since 2011. It’s a similar story for the share of under 90 days delinquent cards, which sits at about 9%, and are also at highs not seen since 2011. Even more alarming, is the share of active credit card accounts making just the minimum payment is now at a 12-year high, according to data from Philadelphia Federal Reserve. It’s likely these borrows will never repay there full loans. NBC News

As debt grows, people turn to debt reduction strategies. This is another point of data we can examine. Often, personal loans and HELOCS are used to consolidate loans. An increase in these can be taken as a another sign of the overall debt burden increasing among Americans. USA Today reports that the total outstanding personal loan balance in America is $249 billion – an increase of 64% over the past five years. By comparison, credit card debt rose 33% in that same timeframe. According to lending tree, almost half of borrowers (49.9%) take out a personal loan to consolidate debt or refinance credit cards.

Experian’s data corroborates this, showing a massive 9.7% increase in Home Equity Lines Of Credit (HELOCs) from ‘23 to ‘24. This increase could explain the slight 3.2% reduction in personal loans in 2024. Swapping one loan type out for another. A transfer of debt spurred by rising home valuations with better rates rather than a better ability to repay any of it.

With the increase in borrowing, it follows then, that a Forbes survey revealed almost 70% of respondents reported using over 20% of their income to repay debt.

3. Decreased Repayment Power

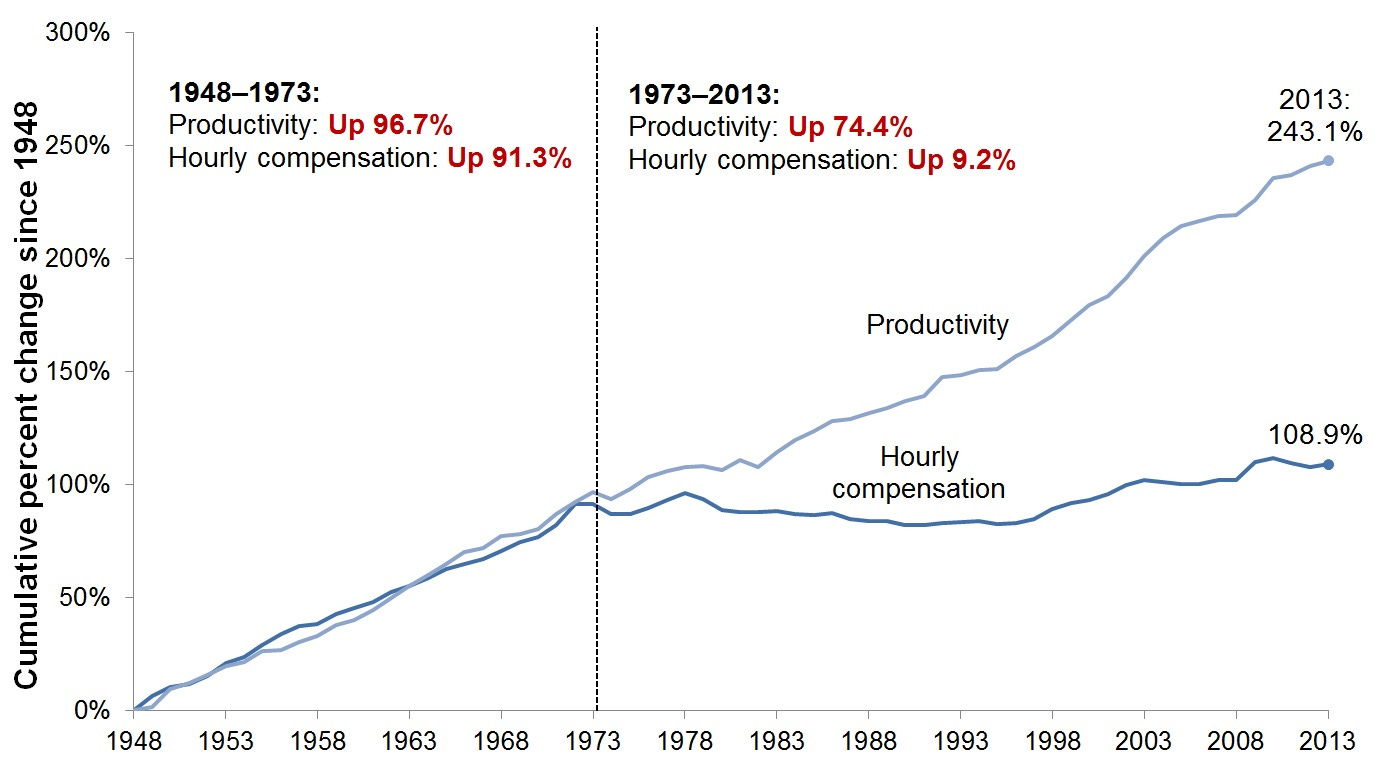

A well known fact is that American workers’ wages have been stagnant for decades. Purchasing power is not rising and wages are not increasing fairly with the increase in productivity. The study that produced graph below is from 2015, but things haven’t changed much.

A recent Forbes article talked to several financial professionals. They are in agreement that, still to this day, trends in unemployment and wage growth are reducing the spending power of Americans. On the flip side of the trade, prices have been increasing. Americans are facing higher home prices and mortgage rates while also grappling with more debt than ever before. We can plainly see the purchasing power of the consumer dollar decreasing over the last five years alone when looking at the US Consumer Price Index. This is a 20 percent drop in value from the 39 mark to the 31 mark ((8/39)x100). We’ve lost 20% of the purchasing power we had five years ago.

We can see further proof of the American financial struggle by looking at savings rates. The American savings accounts grew appropriately for most of the 2010s with people saving around 6% to 8% of their income. Then in 2020, nationwide lockdowns and government stimulus sent the rate skyrocketing to 32%, a once-in-a-lifetime spike. Currently in 2025, savings rates sit around 3.5%, as inflation, debt, and the cost of living take 97% of people’s income. 3% savings is nothing. If you make 50k a year, you’ll manage to save 1.5k that whole year. Is that enough to cover a financial shock like injury, car repair, house repair, job loss, etc?

The same Forbe article also addresses that many people are dipping into retirement savings. “I have seen two trends regarding 401(k) hardship withdrawals,” says Wirtz. “The number of withdrawals has ticked higher, but the average request amounts have ticked lower. This suggests to me that there are stress signs that are visible but not alarming.”

The financial shock of unemployment mentioned earlier? Data shows unemployment is increasing. Research indicates that an increase in the unemployment rate is associated with higher mortality rates, with estimates suggesting that each 1% rise in unemployment could lead to approximately 37,000 additional deaths due to various health issues. This connection highlights the serious health impacts that economic distress can have on individuals and communities.- National Institute of Health

And of course, we also need to touch on growing consumer debt. While debt repayment is declining due to all the reasons mentioned above, the amount of debt held is actually growing! Purchasing power is so low that people have to resort to taking on debt by meeting their needs with credit.

Household debt in the U.S. is at an all-time high, hitting $18 trillion in the fourth quarter of 2024.

Credit card debt is more common than mortgage debt — only 40.9% of U.S. families have a mortgage or home equity loan, while 45.2% carry credit card balances.

About one in five families hold education installment loans, with the median amount being $24,500.

Finally, as in 2008, the levels of debt are so high Wall Street now finds it advantageous to commoditize it - structured finance is back.

“Wall Street is once again creating and selling securities backed by everything—the more creative the better—including corporate loans and consumer credit-card debt, lease payments on cars, airplanes and golf carts, and payments to data centers. Once dominated by bonds backed by home mortgages, deals now reach into nearly every cranny of the economy.

“It’s amazing to me,” said Lesley Goldwasser, a managing partner with GreensLedge, a boutique investment bank that focuses on structured credit. “I have watched this with absolute wonder.”

New U.S. issuance of some of the most popular flavors of publicly traded structured credit hit record levels in 2024 and are expected to surpass those tallies this year, according to S&P Global. New asset-backed securities totaled $335 billion last year. Collateralized loan obligations, or baskets of corporate debt, rose to $201 billion, also an all-time high.” -The Wall Street Journal

*I’d love to dive deeper into this, but it will have to be it’s own article.

4. Government Debt

But it’s no just consumers facing unplayable debt burdens. Our very government is actively at risk of defaulting. Under Biden and both Trump administrations, the deficit has increased tremendously. Some sources predict the US could default as soon as July of this year! Two independent ratings agencies, Moodys and Fitch, both downgraded the US Government’s credit rating from “Stable“ to “Negative”. -Reuters

Exactly like consumers face interest on their debt, so does the US government. Our interest payments alone will soon equal the budget for Military Defense. Admittedly Healthcare and Social Security are huge budget expenses, but I disagree with any politician claiming that cutting benefits to the average American is the only solution. Now isn’t the time or place, but I would argue for a myriad of other cuts and efficiency reforms such as in our healthcare system and defense spending, before disenfranchising tax-paying citizens.

What happens when our government defaults? For starters, the same thing that happens when an individual defaults. Their credit score goes down, they face higher interest rates, late fees, lower borrowing limits, and possibly property seizure. But, unlike an individual, the US Government is a market maker. They are a domino in. a long chain of dominos.

An actual default could trigger a new global financial crisis. Investment bank UBS estimates the S&P 500 could fall by at least 20%. If the U.S. defaults, there's no more money to spend. Government workers and contracted businesses will stop getting paid. Banks, major holders of government debt (treasury bonds), would stop seeing repayments and face losses. Banks could become illiquid, unable to fill depositor withdrawals or lend money. “That's when the financial system freezes up," Wolfers explains. "That means there's no more borrowing, businesses stop investing and the markets go absolutely haywire." - NPR

Not to mention the list of people who may not get vital government benefits, prominently veterans who rely on these payments as a lifeline as well as retirees who rely on Social Security payments. All those missed payments would have a direct impact on the economy. Impacted households may have to reduce their spending, and those with little or no savings might have to turn to credit cards, which carry increasingly costly interest rates. Once interest payments struggle to be met, the spiral only worsens.

Closing Remarks

I hope that I am simply alarmist, stupid, and wrong. But these signs, to me, are real and terrifying. I feel scared as much as I feel angry that the lessons wasn’t learned. That consumers will likely again have to pay the cost for corporate greed. Privatized profits, socialized costs.